Indigenous Oando stepping into major producer roles

Sopuruchi Onwuka

Indigenous energy company, Oando Plc, is underway to becoming the first Nigerian indigenous upstream players to totally displace major international partners as operator in the conventional terrains of the Niger Delta.

The company declared today that it has reached a ground shaking deal to buy up all stakes held by Italian oil major, Eni, in the joint venture operated by the Nigerian Agip Oil Company (NAOC) Limited on behalf of the Nigerian National Petroleum Company (NNPC) Limited.

The portfolios captured in the deal include but not limited to commercial stakes hitherto held by Eni in flour operated oil mining licenses (OMLs) and linked gas fired power generation plants in Nigeria.

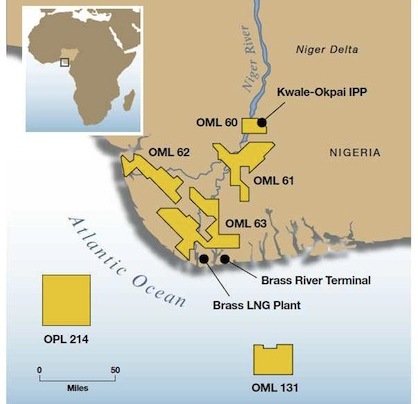

The joint venture operated by NAOC include producing oilfields in OMLs 60, 61, 62 and 63; and Oando would now increase its stake in the oil, gas and power JVs from current 20 percent to 40 percent while ceding the overriding 60 percent shares to the government’s interests held by the NNPC E&P Limited.

The deal, when concluded, “increases Oando’s ownership stake in all NEPL/NAOC/OOL Joint Venture assets and infrastructure which include forty discovered oil and gas fields, of which twenty-four are currently producing, approximately forty identified prospects and leads, twelve production stations, approximately 1,490 km of pipelines, three gas processing plants, the Brass River Oil Terminal, the Kwale[1]Okpai phases 1 & 2 power plants (with a total nameplate capacity of 960MW), and associated infrastructure.

“Based on 2021 reserves estimates, Oando’s total reserves stand at 503.3MMboe and the transaction will deliver a 98% increase. The transaction also grows Oando’s exploration asset portfolio through the acquisition of a 90% interest in OPL 282 and 48% interest in OPL 135,” the company declared in a statement.

Oando stated that NAOC’s 5.0 percent participating interest in Shell operated JV SPDC JV is not included in the perimeter of the transaction and will be retained in Eni’s portfolio.

The Oracle Today reports that Shell is putting up for auction private partners’’ stakes in all operated JV assets as all the multinationals now evidently migrate from the Nigerian conventional terrains into the deepwater and possibly out of the country.

The divestments by the multinational players and their eventual exit from the country are envisaged to present the indigenous firms with the opportunity to crew up the technical roles in the Nigerian upstream oil and gas exploration and production operations.

With the acquisition, Oando might now become the operator and sole partner with NNPC Limited in the joint venture which ranks fifth in production capacity after those operated by Shell, ExxonMobil, Chevron and Total. The deal would now position Oando as the only indigenous company stepping into the shoes of a major multinational major in a JV with government.

The Oracle Today reports that Oando became the only indigenous company in any of the major joint venture and production sharing agreements operated by major multinational oil companies in the country, when it mopped up all equity stakes previously held by American oil multinational, ConocoPhillips in the NNPC/Agip/ConocoPhillips joint venture.

The company which bought up the asset of exiting ConocoPhillips in the country already has the largest network of partnerships with small independent and marginal producers, amassing large equity production from existing operations while maintaining its vision on big ticket opportunities.

Oando which originated in the industry as deal broker, has since 2003 morphed through trading, marketing, gas and power, oilfield services, new energy, exploration and exploration into an upcoming major producer for the country.

Group Chief Executive, Mr Wale Tinubu, stated that the deal amplifies the inevitable roles indigenous firms would play in the future of the Nigerian upstream sector in terms of delivering value for community, government and company stakeholders.

“The synergies created by this acquisition will unlock unparalleled opportunities for us to re-align expectations, enhance efficiency, optimize resource allocation, and significantly increase production. Furthermore, it is in alignment with our strategy of acquiring, enhancing, appraising, and efficiently developing reserves.

Today’s announcement is not just an important milestone for the future of Oando; it brings to bear the important role indigenous actors will play in the future of the Nigerian upstream sector. Having achieved this significant milestone, we look forward to closing the transaction and harnessing the full potential of the enhanced platform to accrue value for our local communities, stakeholders and shareholders,” Wale Tinubu said.

Oando stated that with the acquisition of 100% of the shares of NAOC, completion of the transaction would now be subject to Ministerial Consent and other required regulatory approvals.