Profligacy: How states squandered the future

- Some states cede 30% allocation to creditors

Sopuruchi Onwuka

Nigeria’s independent resource wealth auditor, the Nigerian Extractive Industries Transparency Initiative (NEITI), has declared that the 36 states of the federation conceded princely N129.6 billion or significant 15.8 percent of statutory revenue allocation to service debts in the second quarter of the year.

The report showed that some of the biggest revenue earning states including Lagos, Delta, Ogun, Kaduna and Osun surprisingly suffer huge debt burdens that decimated their revenue allocations in the second quarter of the year.

Similar debt service obligations also sliced off a huge chunk of funds from revenues accruing to states in the first quarter of the year; but the figures were not declared in the statement by NEITI.

On the flip side, less revenue earning states including Enugu, Kebbi, Nasarawa, Anambra and Jigawa states appeared more frugal with funds, resulting in lowest debt service deductions. The NEITI report did not mention any state that is currently without some level of debt burden.

The Oracle Today reports that NEITI maintains oversight on the flow of resource wealth in the country, providing citizens the critical expository information that would enable them hold their political leaders accountable for wealth management.

According to the principles of the global Extractive Industry Transparency Initiative (EITI) from which the NETI is derived, resource accountability is critical for equitable distribution of benefits in a manner that is enduring. The scheme recognizes that natural resource rightly belongs to the past, present and future generations of the country’s citizens; stressing that management of resource wealth must focus on building enduring institutions, infrastructure and facilities that would also benefit future generation of citizens.

Debts that are secured and plundered by political leaders burden the states with financial responsibilities that defeat the prime aspirations of EITI and its country affiliates like NEITI.

The agency pointed at the report by Federation Account Statutory Revenue Allocations which has shown that the 36 states of the country were entitled to receive about N1.51trillion, or 34.5 percent of the total N4.37 trillion shared by the three tiers of the government in the first half of the year.

Revenues for the states in the period comprised from about N817.79 billion from the N2.32 trillion total distributable funds in the first quarter of the year, and another N688.2billion of the N2.04trillion allocation in the second quarter.

Apart from the share of the statutory allocations, NEITI stated, the nine oil-producing states, namely Abia, Akwa Ibom, Anambra, Bayelsa, Delta, Edo, Imo, Ondo and Rivers received additional allocations as their share of the 13 percent derivation revenue realized from their respective jurisdictions; bringing their total receipts to about N869.09 billion.

In the second quarter of the year alone, Delta State received the largest allocation of N102.79 billion among the 36 states, followed by Akwa Ibom and Rivers states, which received N70.01 billion and N69.73 billion respectively.

Ekiti, Ebonyi and Nassarawa States received the lowest allocations of N16.95 billion, N16.84 billion and N16.71 billion respectively, the NEITI report indicated.

In providing details of its latest report on Nigeria’s extractive industry, NEITI reported that most states of the country are currently staggering under the heavy debt burdens which have decimated accruable income and left some states struggling.

In terms of debt repayment, the report showed that the deduction from Lagos state topped the 36 states’ allocations to service pending debts as a result of foreign loans and contractual obligations such as irrevocable standing payment orders (ISPO) and other liabilities standing against each state.

The report showed that Lagos State had to shed significant N9 billion from its allocation in the second quarter of 2023. Delta State also had to concede N6.76 billion to debt servicing. Ogun State suffered N6.10 billion cut from its allocation in the period, Kaduna State was down by N5.63 billion, and Osun State dipped by N5.6 billion.

According to NEITI; Enugu, Kebbi, Nasarawa, Anambra and Jigawa states recorded the lowest deductions of N1.88billion, N1.51billion, N1.45 billion, N1.29 billion and N1.16 billion respectively.

Imo, Ekiti, Gombe, Kaduna and Bauchi recorded deductions that accounted for almost a quarter of their gross allocations, the report said.

After all the deductions, the report showed that Delta State still topped the revenue chart in the period with net allocation of N96.03 billion; followed by Rivers State with N66.81 billion, Akwa Ibom State with N64.81 billion, Lagos State N51.61 billion and Bayelsa State with N51.53 billion.

Plateau, Ogun and Osun states suffered most debt deduction impact in their revenue receipts during the second quarter, NEITI reported. Plateau State, which occupied the 21st position among the 36 states prior to the debt deduction, dropped to the 31st position; while Ogun State descended from the 28th position to 35th; and Osun State slid from 32nd position to 36th position.

The NEITI report expressed concern over how the debt situation is affecting Ogun, Osun and Cross River States. While the debt deductions from most of the states’ allocation left them with significant net take-home, Ogun and Osun debt deductions were above 30 percent. Deductions from Cross River and Plateau states allocations were 29 percent and 28 percent respectively.

However, NEITI stated that Rivers, Jigawa and Kebbi states showed strong fiscal sustainability within the period under review.

The Oracle Today reports that the extractive industry monitored by NEITI accounts for over 90 percent of Nigeria’s balance of payments, over 95 percent of total exports, some 80 percent of total funding support all tiers of government and about 97 percent of Nigeria’s total foreign exchange income.

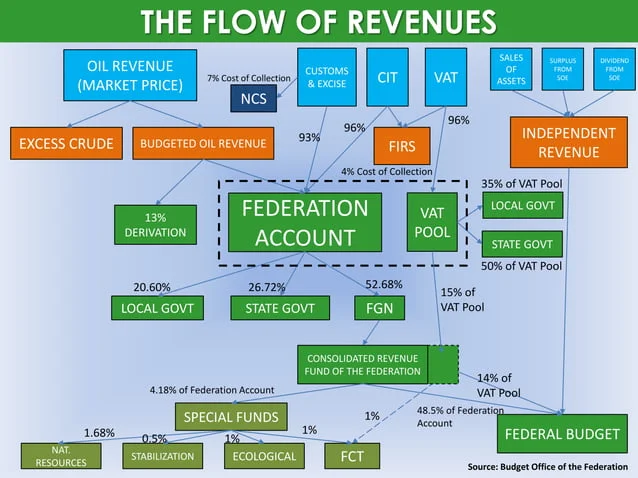

Therefore, tracking resource wealth in Nigeria entails monitoring the funding flow chart of the Federation Account Statutory Revenue Allocations from where funds from all revenue agencies of the federal government are channeled to states and local governments in the country.