Displacing 21 GW coal generation with nuclar demands $249 bn

Sopuruchi Onwuka, with agency reports

It is becoming clearer that the highly hyped energy transition will be a super slow process, promising that fossil fuels would linger long in the global energy mix for a long time into the future.

A survey by The Oracle Today on plans and budgets that would drive the prevailing shift in energy demand from fossil to net zero options shows that the demarcation between clean and dirty fuels are thinning down, while mass conversion of energy systems and infrastructure in favour of green energy call for difficult funding.

Australia which is one of the leading climate apologists just realized that displacing significant 21,000 megawatts of power generation from current coal plants to nuclear power generation would require investment of $249 billion.

According to the country’s Climate Change and Energy Minister, Chris Bowen, the high cost makes such a proposed transition a “unicorn and a fantasy.”

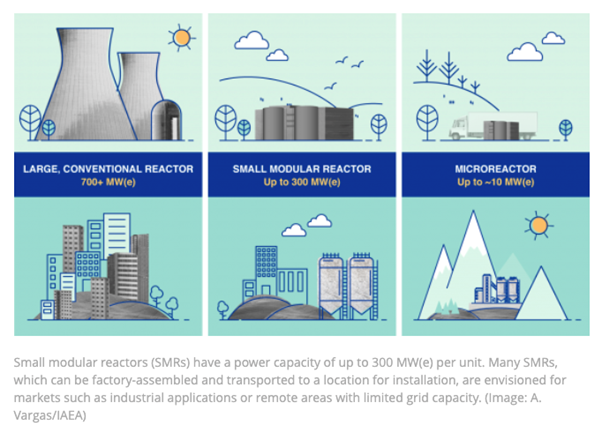

The plan from the Climate Change Department requires that Australia to build some 71 small modular reactors to replace the 21 gigawatts of coal-fired power in the system, but Bowen dismisses as worse cost option for the country.

The Oracle Today reports that billionaire climate activists, including Bill Gates and Jeff Bezos, canvass for small modular reactors in phasing out coal, fuel oils and natural gas in power generation; but cost of developing nuclear reactors for power generation is fraught with its own cost, safety and security concerns.

Other sectors that play significant role in fossil fuel demand and consumption include motoring, aviation and maritime transportation. Whereas aviation and maritime remain way behind the energy transition race, motoring is generating critical momentum in energy demand shift from fossil.

Our checks show that all traditional automobile brands in the world are ambitious with capacity expansion for electric vehicle production, with newer brands like Tesla leading the all electric automobile movement.

Tesla, an American brand, is joined in the EV race with automobile giants like Ford and General Motors. All European auto brands are also in the EV fray as the 2040 regional deadline for total transition from internal combustion engines draws closer.

Thus, from Japan to South Korea and China, the rave for EVs has redefined automobile market competition across Asia.

In the United States, over two million light-duty electric vehicles are already registered and were on-road as at 2021. And about 2.03 million EVs entered the US roads in just nine years from 2012 to 2021.

The U.S. Energy Information Administration (EIA) had in its Monthly Energy Review in August 2023 reported that the number of U.S. registered light-duty electric vehicles (EV) on the roads reached 2.13 million vehicles in 2021, a sharp increase from the less than 100,000 EVs on the roads in 2012.

The EIA stated that battery electric vehicles (BEVs) accounted for the largest share of registered EVs in the United States in 2021, at 65%. Of the 2.26 million EVs registered in the United States between 2012 and 2021, about 135,000 were no longer on the road in 2021.

Although there is no official deadline for universal migration of energy options in the transport sector, the US government has supported EV growth through supportive policies like EV purchase incentives, zero emission vehicles sales requirements, and fuel economy standards.

With the government policies in place, EVs have become more popular in the United States over the past decade following consumer preferences, increasing EV models, and expanding luxury car market.

The EIA stated that clean energy cars dominating the US market include battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

BEVs use only an onboard electric motor powered by a battery pack. PHEVs use both onboard battery packs and an internal combustion engine.

In 2021, the average EV in the United States was 3.6 years old while the average non-EV was 11.1 years old. The average EV is considerably younger than the average non-EV because of the relatively recent surge in EV sales, the EIA said.