AEW: Austin Avuru mobbed in Cape Town

Sopuruchi Onwuka

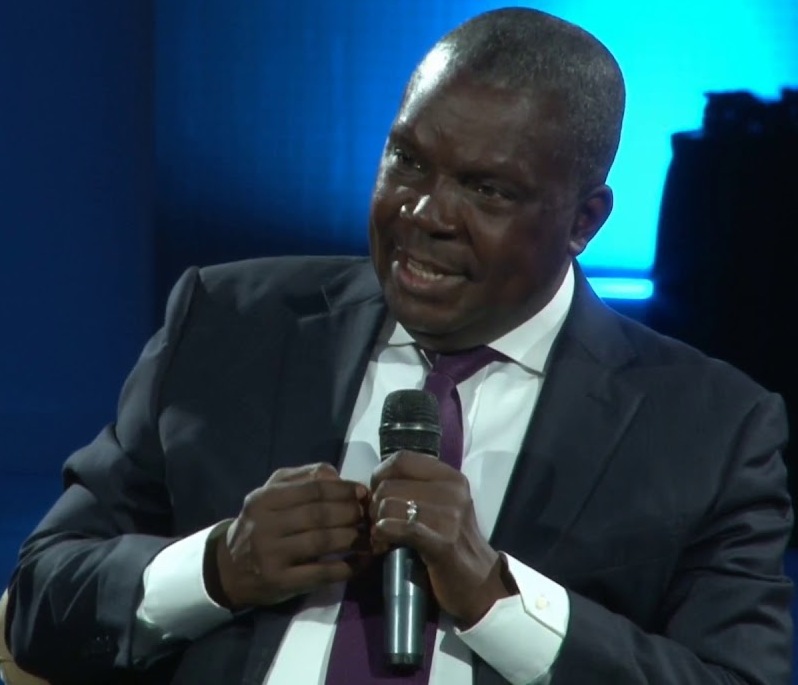

Nigeria’s petroleum industry connoisseur, Mr Austin Avuru, was unable to leave the Elephant Stage at the just concluded African Energy Week, in Cape Town, South Africa, after delivering an inspiring presentation on emerging investment opportunities in the Nigeria petroleum industry.

Delegates who thronged the Elephant Stage which was exclusively reserved for ministerial and diplomatic presentations and panel discussions besieged Mr Avuru after he dissected the presentations delivered by the Minister of State for Petroleum Resources, Senator Heineken Lokpobiri, and the Presidential Adviser on Petroleum, Mrs Olu Verheijen.

Mr Avuru who is the Chairman of AA Holdings is a member of the Independent Petroleum Producers Group (IPPG) sat in the penal with Senator Lokpobiri who chaired the AEW Town Hall on Invest in Nigeria Energies session. Other members of panel were drawn from international oil companies and oil services providers.

In hs opening remarks at the event Senator Lokpobiri had summarized policy reforms in the Nigerian industry space and invited players from all parts of the world to explore opportunities in the country, declaring that the government has floated new incentives for new investments.

“Nigeria is ready for business,” he told the global audience.

In a long address she read out at the event, Mrs Verheijen pointed out that Nigeria’s great resource potentials have underperformed under scanty investment inflow in the past decade, noting that global investment funds have bypassed Nigeria onto neighboring African countries.

Consequently, she stated, Nigeria has the world’s largest population without electricity and, according to Mrs Verheijen, the country loses over 40 percent of her gross domestic product to lower supply deficits.

She told the delegates that the present administration of President Bola Tinubu is responding to the situation with bold industry reforms that targets to make the operating environment more congenial and rewarding to investments.

She listed non-fiscal incentives floated by the government to include innovative data driven approach to policy making, streamlining of approval processes, shortening of process cycle time and elimination of cost premium on upstream projects.

The new incentives, she said, has attracted over a billion dollar investment in the past one year while arrangements are underway for two investment decisions in the coming year.

While the politicians struggled to paint pictures of Nigeria’s attractive fiscal and physical environment for new investors, delegates awaited to glean out specific business intelligence from stalwarts who have traversed the industry and emerged with solid results.

The Head of West African Upstream Research at Wood Mackenzie, Mansur Mohammed, allowed the microphone to pass round; and when Mr Avuru began real interpretation of the reforms happening in Nigeria, the entire hall went dead quiet!

Chairman of AA Holdings, Mr Austin Avuru (3rd right) poses with delegates at the AEW 2024 in

Cape Town, South Africa

He told the audience that the Nigeria petroleum play was undergoing multiple and simultaneous transformations triggered by phased portfolio rationalization by the international energy majors and accelerated by bold policy reforms of the Tinubu government.

The changes, according to Mr Avuru, have created room for multiple collaborations among investment groups in reordering events that would now activate a new wave of activities across the full industry loop. He also pointed out that strategic moves by players to navigate existing challenges in the environment have started a new order of integrated operations where companies now stretch their activities longer within the value band.

In expressing excitement about new executive orders that have quickened the hands of regulators to approve lingering divestment transactions initiated by international oil companies seeking to exit brownfield onshore and shallow water assets in the country, Mr Avuru called for consistent policy thrust and sustainable regulatory frameworks that with set off superior oilfield activities and deliver on prevailing industry mandate to double production.

He noted that the onshore and shallow water assets being divested by the oil majors are still prolific; explaining that the current drop in output resulted from lingering divestment approvals that created investment hiatus on the assets. He made it clear that the recent approval of the divestment transactions would now unlock new investments in enhanced production and reserves replacement.

Mr Avuru also pointed out that the new policy thrust and executive orders have jointly propelled new upstream investments, adding that a string of approvals for midstream processing facility developments are also laying business case for integrated oilfield operations that would build value on produced oil and gas.

In the downstream, Mr Avuru pointed at key backbone infrastructure projects driven by the Nigerian National Petroleum Company (NNPC) Limited, price deregulation in the domestic fuel market, domestic gas price mark-up, and tariff corrections in the electric power sector as great commercial incentives that lay strong proposition for new investments.

Besides policies that confer commerciality on investments, Mr Avuru stated that the prevailing reform agenda would also stimulate activity in the industrial sector through supply of over 4.0 billion standard cubic feet (Bcf) of gas per day in the short to medium term, unlock the electric power sector for effective gas demand, and usher in a sustainable and improved electricity supply to homes and businesses under a cost reflective tariff regime.

As Mr Avuru painted different scenarios for segments of the industry, applauds interrupted and interjected his comments, prompting the moderator to call for calm.

Almost all other members of the panel, including Senator Lokpobiri, drew references from Mr Avuru’s comments to drive their points home.

Senator Lokpobiri told the international audience that Nigeria still respects free entry and free exit by investors, adding that government has no objection to the ongoing divestment programme by oil companies in the country. He stated that the divestment programme has instead provided good opportunity for indigenous companies to assume greater roles and responsibility in the industry.

He explained that the country’s traditional partners are still with Nigeria, adding that the IOCs are only divesting suboptimal assets for new investments in new developments in the unencumbered deepwater terrains where only big players which strong financial muscle hold sway.

He stated that the Nigerian petroleum industry holds big space for all players, adding that the indigenous players have more responsibility in the prevailing situation to build resilience and sustainable capacity.

Senator Lokpobiri declared that the administration of President Bola Tinubu is working to dismantle all bureaucratic bottlenecks and other entry barriers to enhance ease of access to the huge opportunities the Nigerian industry environment offers investors.

The Oracle Today reports that the Invest in Nigeria Energies turned out to be one of the most exciting country spotlights at the Africa Energy Week 2024, puling full attention of industry delegates who swooped on Mr Austin Avuru for further business intelligence at the end of the session.

While others had left the stage Mr Avuru who is founding Managing Director of Seplat Energies Plc, founding Managing Director of Platform Petroleum Limited, and controlling equity holder in Pillar Oil was besieged by sundry industry executives seeking his insights and connection.

Mr Avuru’s right hand was shaken sore by innumerable hands, white and black, as he milled around the stage to shake more and more outstretched hands. Business cards flew in the wind as each handshake also slipped out contact card.

There was no order, and Mr Avuru politely continued to swirl round and round to shake more hands and pack up more business cards. He also took out time to share out his own cards until he had no card left.

The event organizers at the hall came to rescue by announcing the commencement of the next event and requesting all delegates to take their seats. Mr Avuru kept his smile as he fled the hall, but unfortunately ran into another set of delegates outside the hall who engaged him in another round of networking banters.

At this point the Nigerian petroleum guru had to slowly march down to the exit as he kept greeting more and more people along the lobby.