Tinubu’s reforms enable petroleum business to drive the economy __Avuru

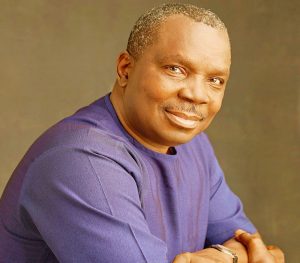

It is rare to have Nigerian from the Niger Delta who walked away from NNPC job to give practical expression of what potentials indigenous capacity holds for realization of prime national economic aspirations for the petroleum industry. Mr Austin Avuru is an eminent geologist who has earned immense experience in oilfield operations, high level executive management, high-risk high-return investments, industry leadership, policy advocacy and investment advisory. Mr Avuru is the founding Managing Director of Platform Petroleum, founding Managing Director of Seplat Energy Plc, lead investor in Pillar Oil, and currently the Chairman of AA Holdings. He is an eminent Fellow of the National Association of Petroleum Explorationists (NAPE), Society of Petroleum Engineers (SPE) and a member of Institute of Directors (IOD). He commands the respect and audience of industry leaders.

In this chat, Mr Avuru analyzes how the prevailing reforms in the Nigerian petroleum industry are transitioning the country from cash oriented commodity exporter to Africa’s hub for integrated energy solutions.

Enjoy the excerpt.

You expressed excitement about the new policy and regulatory changes in the petroleum industry. May we share your optimism?

From the upstream point of view, we are seeing a regulatory push that now recognizes the there are many home grown independents who are likely in the near to medium term to be operating in the onshore and shallow water; while the IOCs will control the deep offshore.

The policy shift also recognizes that this shared responsibility between the independents and the IOCs will complement parallel growth efforts in the entire economy. So that collaboration and shared responsibility will lead reinvigoration of the Nigerian petroleum industry; with optimum production coming mature fields in the onshore, fields in the deep offshore and additional exploration efforts across all the basins. So that should lead in the medium term to optimum production.

In the midstream, we are seeing a lot of gas processing and developments going on, particularly with the IOCs intended to supply 3-4Bcf/d that the domestic economy requires to power industries, petrochemical industries, power generation, fertilizer production and so on. So, that is beneficiation.

That is enabling the oil and gas business, especially the gas business to be a major driver of the economy.

When you go further into the midstream, you will see the country now becoming a major refining hub. So, it is going to a point where in the next three years we have a refining capacity in excess of 1.2 million barrels per day. So even at the 2.5 million barrels per day (mbd), if we get there, you will find that half of our production will be refined locally.

If we have 1.25 mbd refining capacity in the country, our consumption will probably not be up half of that: we will be probably be consuming between 400kbd-500kbd, which means we will have a huge export potential for our refineries across the sub-region and the continent. And then, further down, we will see particularly local independents in products distribution and gas processing.

So, what you are going to see is an integrated business that earns revenue for the economy, but more importantly supports industrialization of the economy and boost our GDP much more than what we are seeing today.

I like the aspect of gas stimulating growth in the local economy. But there is a business case concern about the capacity of the domestic gas market dominated by the power sector to make effective demand?

The demand capacity in the local market is not limited. What is limited is the level of growth and stability of that market.

Take for instance; we are still struggling with the power industry. By the time we have sustained 20 gigawatts of power supply, and when the power market is developed to a point where it is mature and becomes stable, with steady supply, we will need about 2 Bcf/d of gas or the power sector alone.

Now, once you have a stable demand side, then investments in the production side will lead to stable supply. So when that market matures and become stable, we are going to see a direct link between demand and supply. It will then give you greater confidence to invest in the supply or demand side of the chain. But pricing is already no longer a barrier. Those who are supply gas either to industries or power sector are selling gas at above $2 per mmbtu. And really anything above $2 per mmbtu can sustain the gas business. Those who are in it, companies like Seplat and Platform, will tell you that their gas business is commercially viable.

All I am saying is that we just need the market to develop to the level of stability for both the supply and demand side of the business to form symbiotic existence.

There is the new government mandate on the industry to rebuild production by additional million barrels per day. And this is coming at a time traditional Niger Delta play is getting increasingly mature and output from deepwater is in decline. From which side of the terrains is additional one million barrels possible?

This time I will talk as a geologist and an explorationist.

If you look at all the independents that bought assets, most of them started as marginal field operators.

Any marginal field operator will tell you for instance: ‘we were assigned a marginal field with 2P reserves seven million barrels. We have produced 12 million barrels and still producing.’ That is the story you always hear from them.

So, what we call mature field from a geological point of view are those assets where the easy plays, the easy discoveries have been made, the easy to be developed fields have been developed, but there is still substantial reserves. It requires more technology, higher cost, more diligence to develop. But it is there.

So, when you see an asset that you think holds 100 million barrels, by the time you bring in technology for secondary recovery, you would probably recover 180 million barrels of reserves.

So we are now in phase II of the Nigerian oil and gas play when we are going to squeeze out the remaining barrels of oil. Not that they were not there. They are there but they were not captured in the original 2P, which why in any reserves estimate you have 2P and you have 3P. We are now going to be converting our 2Ps and 3Ps into 1P and put them to production.

So, almost in every basin, when you say it is mature, you probably have as much left as you have produced. But it requires more intense technology and more diligence at higher cost.

We are no longer hearing declarations of huge discoveries from the Nigerian deepwater. The latest discoveries were attributed to appraisal drillings despite the decades of activities in the offshore. Does it mean the Nigerian deepwater prospectivity has declined? Or are we out of reserves?

As you may have heard in the presentation by the Presidential Adviser, the Nigerian deepwater basin has not seen any serious exploration work in the past 13 years.

After the first rash of exploration that discovered about 8 billion barrels, they have all gone into production mode. That is the production you said is declining! Again, with the kind of policy thrust we have today, they are now incentivised to go back to exploration mode both for oil and for natural gas.

So, you are going to see new exploration outcomes, either near field discoveries or even exploration discoveries. And that will happen even onshore that is so mature that is 60 years old. You heard Chevron the other day announcing near field appraisal discovery in an asset that has been producing for more than 45 years. So, those potentials are still there. And those are the potentials that the new players are going to chase because they hold the opportunity for optimization.

There are several comments about the right policies and commitments to attract the right set of investors, and also to match capacity with opportunity in the upstream industry? How can government ensure that the right players get assets to operate?

There is a regulatory tool to ensure that only players that have requisite capacity play in the industry. Like in the banking industry, there is a regulatory methodology to weed away those who do not have capacity and ensure that only those who have capacity are allowed to play in the industry.

So, there are regulations and laws in place that enables the regulator to ensure that if you do not implement the work programme you have submitted, and the FDP that you have submitted, the regulator can take back your asset. So there is a regulatory tool that ensures that those who have capacity over time and therefore can implement the work programmes they submitted are the ones who will continue to be in business. Those who do not have capacity will have their assets taken away. It may take time and it will take regulatory courage: but the regulatory tools are there to ensure that only those that have capacity are left in the industry.

I am confident that, among the divested assets, both those who have demonstrated capacity and can grow their capacity, and those who do not have capacity. But over time, those who have capacity with overtake those who do not have capacity. The oil and gas industry won’t be an exception. We had it the same way in the banking industry. From 126 banks, it came down to 24 banks: with five that are very viable and are very active across the entire Africa. This won’t be any different. I can tell you from my experience that in the next few years we are going to come out with about five strong independents and about another 10 smaller independents and marginal field players. But together, they will account for about 80 percent of production from independents and probably about 50 percent of production from the entire country. I am confident about that.

So, it is the company that has capacity that will bring the investments we talk about. When it comes to capacity I really never wanted to be specific. But when it comes to specifics, I can tell you that in the past 10 years Seplat has drilled an average of seven to 12 wells each year. That is investment. If you read their annual report you will see that between 2010 and now how many billion dollars they have invested in their assets. So capacity is what gives rise to investments. Those who have capacity are those that are going to invest in the assets and grow production.

The FIRS cited at the National Assembly that average cost of production has escalated to about $40/bbl; and this coming at a time government is pushing the industry to cut down to $10/bbl. What do you think are the cost drivers?

First of all, I don’t think the average cost of production is $40/bb/. There are costs as high as $40/bbl; and there are costs as low as $10, $12 per barrel. It cannot be $40/bbl on the average. However, considering we are coming from $3/bbl some 30 years ago, even $15/bbl is considered a significant rise in production cost.

When you look at the fiscal details of the PIA, you will find out that every decent operator who knows what he is doing doesn’t need the government to remind him to cut cost to remain in business and get profitable. The PIA is modelled in such a manner that low cost operators have the highest tax incentives. High cost operators suffer tax penalties.

Again, coming back to capacity, by the time these independents build sufficient capacity, they on their own will reduce their cost to the barest minimum in the interest of their business practices so that they make profit.

In the second phase of operations in the Niger Delta, we are going to be unlocking dormant fields to boost production. That is why I defined maturity. It means that all the easy to find and develop assets have already been produced. So, we are going back to the second phase: the bypassed plays, the dormant fields are the ones that are going to be unlocked. That is why I said that the reserves we have left are as probably as much as we have produced; but we need more technology and more diligence to then unlock the dormant assets.

What will likely be the impact of the prevailing policy and regulatory shift on the industry?

Let me put it this way. The divestment in which we participated at Seplat some 14 years ago in 2010 had no methodology. Between 2010 and past two years, there was really no regulation nor framework for asset divestments. We simply went and did transaction with the IOCs. And it is only when we brought to the table for approval that we then started dancing around it.

The result has been that in the past five years, those who were divesting are hung in there. They haven’t left. And those who are acquiring could not take over. What happened was there were no investments in the assets because both those who are leaving and those who are coming in none of them could invest in the assets under transaction.

And now for the first time, we now have a regulatory framework. It may not be perfect, but today in any divestment process, the NUPRC has a framework which says ‘this is how it should be done. These are the terms upon which it can be approved.’ It is now being streamlined and therefore we are beginning to get consents that we weren’t seeing in the past five years or so.

The same goes for the Ease of Doing Business Presidential directive and the development of deep offshore gas. Those are the policy directives that are unlocking things that were stuck in there in the past 15 years or more.

So, what I said about changes in the policy arena is not meant to patronize the government people who were there. No! I am seeing for the first time what we saw in 1991 under Professor Aminu when he came out to say, ‘we want to achieve this reserves base and these are the things we are going to do.’ And that was how he unlocked the deepwater.

So today, we are seeing recognition by the government, particularly by the office of the Special Adviser, that there are things to be done to unlock the bypassed places in the mature basin that you are referring to. And those policy thrusts are what they are putting in place.

And you cannot wish away the independents! It is the independents that play in mature basins. Nigeria is not an exception: whether you go to North Sea or any where it is the same. Perenco is Gabon. Mature basins belong to independents. So once we have now reached that point of recognition that independents have to be supported to build capacity, then you are doing the right thing because it s these independents that will unlock additional production from mature assets.

How do you think all the reforms in the industry would translate to energy security and affordability in the domestic economy, especially in view of the rising cost of domestic fuel in the country?

We have run an industry for about 40-50 years and were addressing the energy needs of countries around the world, and all we were interested in was revenue. We are moving away from that now and we are addressing our own energy poverty. And when you address energy poverty, it will trickle downs to every aspect of poverty.

So, now, I believe that with some of the gas developments we are seeing by independents we are moving to a point where we will have enough LPG production in-country to meet local needs and growing demand. So, when you see the gas plants under development, each of them has an LPG component. Before now, LPG could only be produced by refineries, and once the refineries were down, there would be no LPG.

So, we are moving to a point where LPG is for the masses. And that addresses clean cooking.

And now gas-to-power: to achieve power in the next five years, the greatest beneficiaries are the common man.

So, once we are moving the industry towards solving our energy poverty and problems, as a country and as a continent, we can say really that we are turning the industry around to benefit the poorest person on the street.

Looking at the growth prospect for the independents, do you envisage any of them turning into a global player in the long run?

The independents have to decide the most appropriate geography to operate in. otherwise I can tell you that in the next five years, a company like Seplat can operate anywhere in the world. It can operate at the level of an IOC. As a matter of fact, once they integrate the ExxonMobil assets into their current portfolio, they may no longer be referred as independent.

Let us define the scale. Once they integrate existing Seplat and ExxonMobil assets into their operations, operated production will be in excess of 200,000 barrels per day. Their operated gas processing capacity will be about 1Bcfd. They currently 460MMscf/d. They are developing additional 300 MMscf/d in the ANOH gas project. They just started Sapele gas plant, and that is some 85 MMcf/d. If you add all that up, they close to 1Bcf/d. As IOCs, what was Texaco producing, what was Eni producing?

So a company that is capable of delivering 1Bcf/d and over 200,000 barrels of oil per day, they are more than some IOCs in terms of production. So we are developing independents in Nigeria and we should be proud of that. Independents are operating in Nigeria at the level of IOCs. And in those days we grew up thinking that they alone and God were capable of doing what they were doing.

A lot of players have decried high entry barrier in the industry. How do we leverage the prevailing thirst for more production to lower the entry barrier and allow more participation in the upstream play?

That is a regulatory duty. The regulator knows that his job is to emphasize vibrancy in the industry. And if he is implementing what I described earlier in the PIA as drill-or-drop, then we are going to see regular bid rounds. And people who have capacity will have more opportunity to participate in those bid rounds.

So, if the bid rounds are regular, then over time those who have the thirst will participate in those bid rounds and acquire more assets, and those who do not have the thirst and the capacity will fizzle out.

It is a primary regulatory function to ensure that regulations and implementation of the regulations are targeted at ensuring that there is vibrancy in the sector. If they do it well we will see vibrancy; if they don’t do it well, then we relapse into redundancy.

How can government model the gas sector to be responsible for cash calls from gas suppliers without regular interventions from government?

It is already modelled that way. The power sector the way it is modelled has capacity to pay. What we have not seen in the past is a stable market. And that stable market didn’t grow because we stifled the tariff at the power end.

So, when we didn’t have a market driven tariff regime in the power sector, the distributors didn’t earn enough revenue to pay the generation companies and the generation companies didn’t have enough money to pay for gas.

Now, if you look at what they are doing in terms of deregulating the power sector; it is to achieve a market driven sector where the entire valuechain from gas to generating companies to distribution is serviced by revenue that comes from the market. If you see I have always emphasized market stability in everything I have tried to explain. Once you achieve that market stability at the demand side-power and industries, then you will also achieve stability at the supply side because then the revenue will be enough for the entire valuechain.

So the structure is there, all is required is to achieve market stability so that the market itself pays for every service within the valuechain.